superchuck500

U.S. Blues

Offline

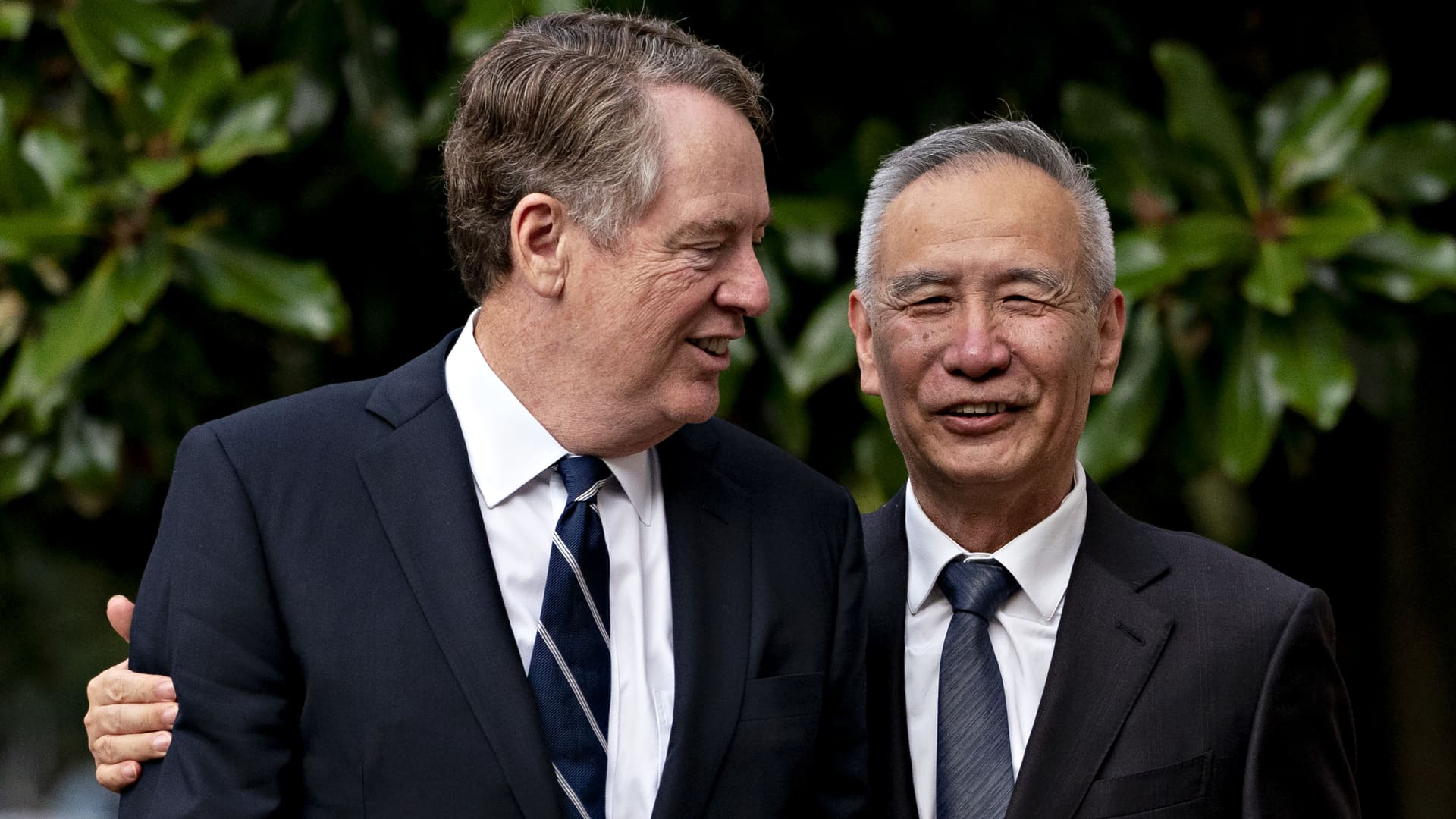

Is there a trade deal with China? Is it really a deal or just a pull-back to status quo ante? Is Trump advancing US interests in this well-executed trade battle plan or was this poorly conceived from the start . . . and harmful?

I think the jury's still out, but I haven't seen that the Chinese are offering much in compromise - and it's not even clear if there's going to be an agreement. But it's clear they are working on something and I'm sure Trump will sell it as the greatest trade deal ever. The proof will be in the details.

I think the jury's still out, but I haven't seen that the Chinese are offering much in compromise - and it's not even clear if there's going to be an agreement. But it's clear they are working on something and I'm sure Trump will sell it as the greatest trade deal ever. The proof will be in the details.